Hello everybody, are you also looking for something about Milestone Credit Card? If yes, then stay on this post, because your search will end here.

I will give you complete information about this Milestone Card like, what is Milestone Credit Card, its benefits and features and login, how to activate it and how to apply for it.

Along with this, all the information about its credit limit, fees and customer services etc. in detail and that too in very simple language.

What is the Milestone Credit Card?

The Milestone Credit Card is made for people who want to build or fix their credit. It has many tools that make handling your money easy, such as:

- No security deposit required

- 24/7 access to your account

- Credit reporting to major bureaus

- Rewards on purchases

Features of the Milestone Mastercard

| Feature | Details |

|---|---|

| Credit Limit | Up to $700 |

| Annual Fee | $75 for the first year; $99 thereafter |

| APR | Approximately 24.9% for purchases |

| Foreign Transaction Fee | 1% |

| Late Payment Fee | Up to $41 |

| Credit Reporting | Reports to all three major credit bureaus |

| Rewards Program | None |

Benefits of the Milestone Credit Card

The Milestone Credit Card offers several advantages:

- Build Credit: Ideal for those with a challenging credit history.

- No Security Deposit: You don’t need to put down a deposit to get started.

- 24/7 Account Access: Manage your account anytime, anywhere.

- Rewards: Earn rewards on your everyday purchases.

In short, here are the Milestone Mastercard’s most important features:

- No security deposit required

- Starting credit limit up to $700

- $75 annual fee first year, $99 thereafter, plus potential monthly fees

- Free credit score access

- Pre qualification available without affecting credit

- Reports to all 3 major credit bureaus

- No rewards program

- Basic fraud protection

- Online and mobile account management

- Customizable card design

Milestone Credit Card Fees and APR

The Milestone Credit Card is noted for having relatively high fees. Here’s the breakdown:

- Annual Fee: Up to $175 in the first year, followed by $49 every year.

- Monthly fee: Up to $12.50 after the first year.

- APR: The APR may reach 35.9%, which is much higher than the average for comparable cards.

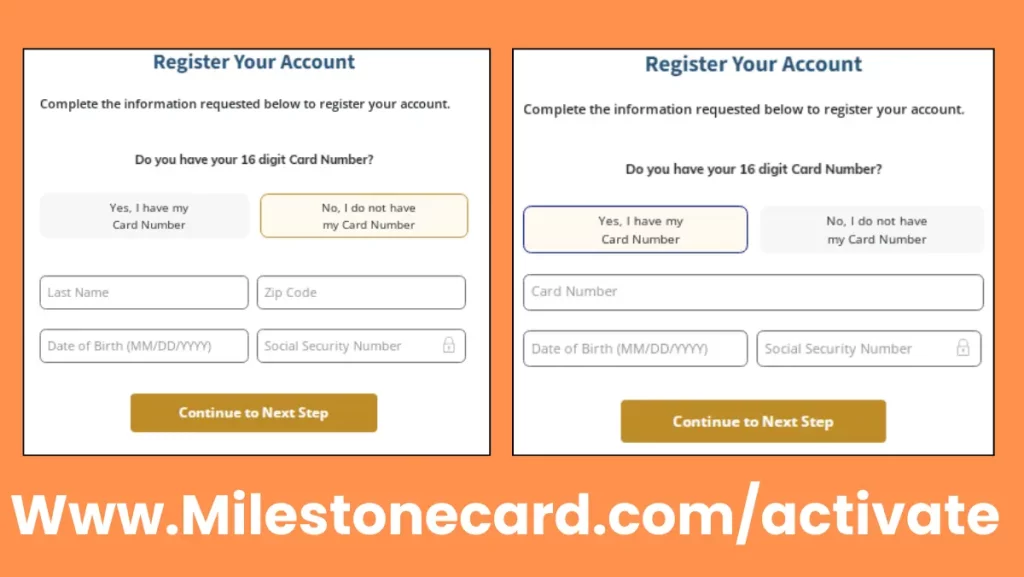

Requirements for Activation

Before you start the activation process, make sure you have the following information handy:

- 16 digit Milestone Card number

- Social Security Number

- Date of birth

- Zip code

Www.Milestonecard.com/activate & Register Your Account

You may activate your Milestone card using one of three ways.

Online With This Link Www.Milestonecard.com/activate: To establish an account and activate your Milestone Credit Card, go to the website and click the “Register Your Account” link. Enter your card details or personal information.

Customer Support Team Phone: Call the activation number, which is generally (800) 305-0330, and follow the automated instructions to enter your card information and verify your identification to finish the activation process.

Mobile App: Download the Milestone Credit Card mobile app, establish an account, then go to the card activation area to input your card information and activate it.

Regardless of the way you pick, the stages include validating your identification, generating account credentials, and confirming activation to begin using your Milestone credit card.

Eligibility to Apply Milestone Credit Card

Eligibility to apply Milestone Credit Card includes the following criteria:

- Credit Score: Suitable for individuals with a credit score of 300 to 670 (bad to fair credit).

- Age Requirement: Must be at least 18 years old.

- U.S. Residency: Legal residency in the United States required.

- Income Verification: Proof of income needed to demonstrate repayment capability.

- Social Security Number: Valid Social Security number necessary for application.

Milestone Apply Card

To apply for a Milestone Card, go to their official website and click ‘Apply Now.’ Complete the application with your personal and financial information, including your Social Security number.

It is critical to carefully read the terms and conditions to verify that all information is accurate. Milestone will review your application for approval once you submit it. If successful, you should get your card within 2 to 3 weeks.

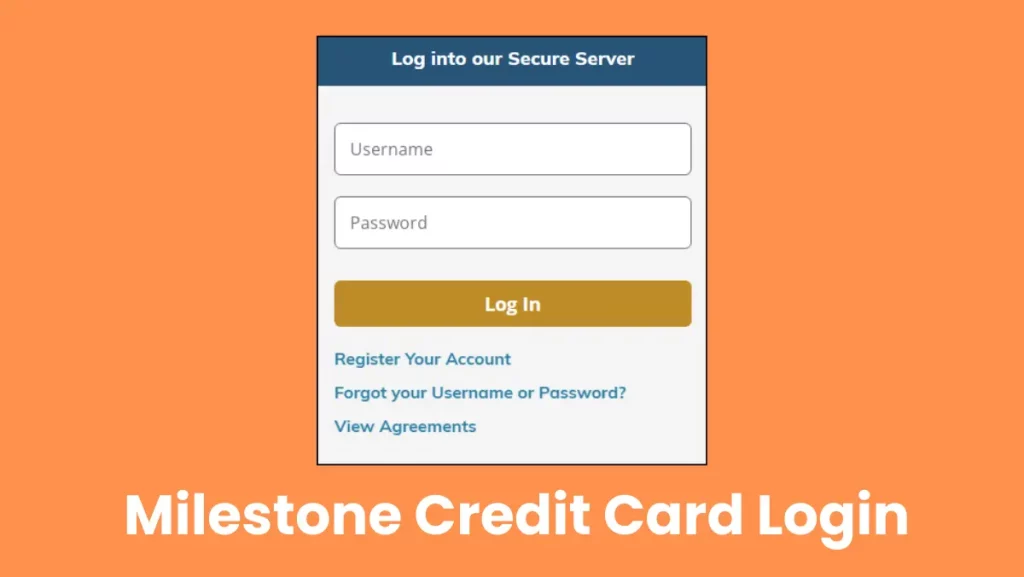

Milestone Credit Card Login

To log in to your Milestone Credit Card account, go to www.milestone.myfinanceservice.com and enter your username and password. To access your account, just click the “Log In” button.

If you haven’t already registered, click on the “Register” link and enter your 16-digit card number, date of birth, Social Security number, and zip code. If you forget your password or username, click the “Forgot your username or password?” link to restore it.

Milestone Card Limit

The Milestone Credit Card has a $700 beginning credit limit, which is ideal for people trying to improve their credit ratings. Credit limits range from $300 to $736, depending on individual financial profiles.

Although no security deposit is needed, excessive fees, such as a yearly cost of up to $175 upfront and $49 thereafter, might lower the available credit limit. Consider alternative low cost credit building tools.

Milestone Credit Card Payment and Login

- Login Online: You may pay your Milestone Credit Card bill using a variety of ways. Online, log in to your Milestone account and complete the payment instructions.

- Phone: To pay over the phone, call customer care at 1-800-305-0330 and follow the instructions.

- Mail To: You may also send a check or money order to Concora Credit, PO Box 84059, Columbus, GA 31908-4059.

- MoneyGram: For MoneyGram payments, go to their website or a local location and enter “Concora Credit” and the number 4911 as payment information.

Pros & Cons For Milestone Credit Card

Pros of the Milestone Mastercard

- Offers an alternative for consumers with a poor or damaged credit history.

- Provides zero liability protection and identity monitoring.

- No security deposit is needed, even with less than perfect credit.

- Fairly large credit limit without needing a security deposit.

Cons of the Milestone MasterCard

- There are no rewards programs or welcome offers.

- Very hefty yearly and monthly costs.

- Very high APR

- Limited credit building advantages and other benefits

- Shocking costs will lead you to better cards.

Milestone Credit Card Customer Service

For help with your Milestone Credit Card, you may contact customer support using the following methods:

- Customer Service Phone Number: Call 1-800-305-0330 for general inquiries and support.

- Lost or Stolen Card: If your card is lost or stolen, dial 1-800-314-6340.

- Report Fraud: To report fraudulent activity, use 1-800-304-3096.

- Technical Support: For technical issues, contact 1-800-705-5144.

Mail Correspondence: You can send mail to:

Concora Credit, Inc

P.O. Box 4477

Beaverton, OR 97076-4477

Customer support is available Monday through Friday from 6 a.m. to 6 p.m. PT. You may also check in to your Milestone account on their website to get more information and assistance.

Questions: Yes/No

Does the Milestone credit card have an app?

No, The Milestone credit card does not yet have a specific mobile app

Does the Milestone Credit Card report to all three major credit bureaus?

Yes, the Milestone Credit Card reports to all three main credit agencies.

Is there an annual fee associated with the Milestone Credit Card?

Yes, there is an annual charge for the Milestone credit card.

Can you apply for the Milestone Credit Card without a credit check?

No, you cannot apply for the Milestone Credit Card without a credit check; the application requires one.

FAQs

Q1: What is the initial credit limit for the Milestone Credit Card?

Ans: The initial credit limit typically ranges between $300 and $700, depending on your credit profile.

Q2: Can I use the Milestone Credit Card internationally?

Ans: Yes, the Milestone Credit Card can be used internationally, but foreign transaction fees may apply.

Q3: How can I increase my credit limit with the Milestone Credit Card?

Ans: Credit limit increases are not guaranteed but can be requested by contacting customer service after responsible use over time.

Q4: What should I do if I lose my Milestone Credit Card?

Ans: Immediately report the loss to Milestone customer service to prevent unauthorized use and to request a replacement card.

Q5. Does applying for the Milestone Credit Card affect my credit score?

Ans: Yes, applying for the card involves a hard inquiry, which may temporarily impact your credit score.